PAYE & CIS Payroll Service

PAYE and CIS for Small Businesses

I offer a comprehensive PAYE and CIS payroll service for small businesses. All I need is once a month figures for each employee on your payroll.

It’s simply a case of you, the employer, giving me the basic working hours information and I will give you the output in the form of payslips to be distributed and a list of payments for you to make.

For what used to be known as ‘Salaried’ staff members all that is required is their annual salary which remains set until changed.

If you have staff on monthly salaries, I only need overtime or expenses amounts when they apply. For hourly paid workers I need each employee’s hourly rate, the number of hours worked, overtime hours worked and (if different) the overtime rate.

Note that for monthly paid staff who do overtime, or hourly paid workers I can provide them with a timesheet app to save you the trouble of recording their hours. You will be able to log into the same app and check your employees time sheets. This system can also cater for staff expenses and bonuses. So why not get your employees to do most of the work?

For CIS workers in the Construction Industry Scheme, all I need is their individual UTR’s and the invoices they present to you.

Registering for PAYE

As soon as you have any employee earning more than £123 per week, you MUST register as an employer. This is the case for ALL business structures: limited companies, partnerships, and even if you yourself are ‘self-employed’.

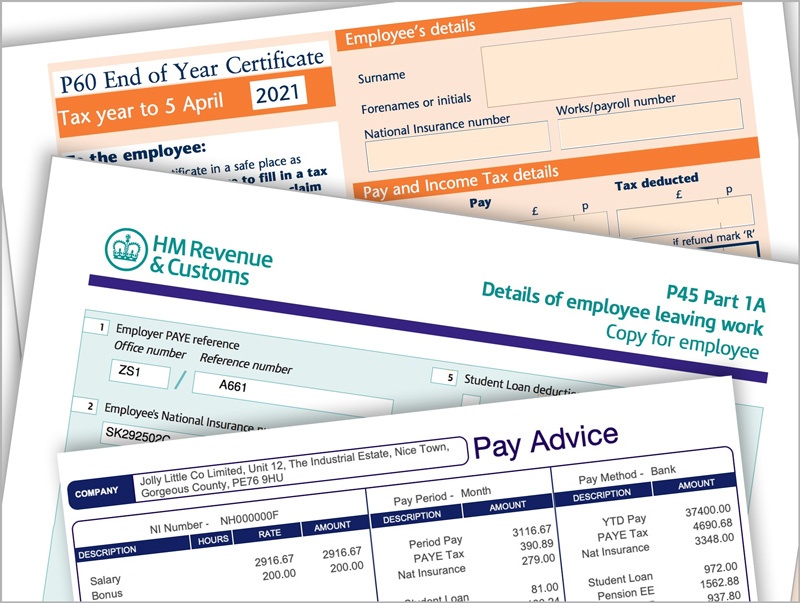

P60, P11D and P45 Outputs

As part of my complete payroll service, I also provide end of year P60’s for each of your employees, and P11D’s for any employee who requires one. P45’s will be provided whenever required. P60’s and P11D’s are delivered either in paper form or by email and can also be distributed directly to your employees, if you wish.

P60’s & P11D’s are available approximately 4 weeks after the end of each tax year (around the end of April) and P45’s are available within one working day of request.

PAYE and CIS Information Links

Please follow the link to HMRC for more information:-

PAYE and Payroll for Employers

Visit our Client Pages for more articles …