Your First Self Assessment Tax Return

When you do your first self assessment tax return, it’s important that you get things right: This is because when you first start up a new business you are allowed to claim capital expenditure deductions against any equipment that you already own, that is now to be used in your business. For example; tools, machinery, musical instruments, computer and office equipment or vehicles you have purchased prior to the date you started.

In your first self assessment tax return, you can also claim back service expenses for the six months prior to the date you started. This is deemed a reasonable ‘getting ready’ period for expenses prior to startup.

Capital Allowances

The key rules are as long as its still in use and it’s being used for your business:-

- Office Furniture

- Office Equipment

- Computer Equipment

- Networking Equipment

- Telephones and Telephone Equipment

- Mobile Phones

- Vans and Goods Vehicles

- Farm Vehicles

- Farming Machinery

- Musical Instruments

- Sound Equipment

- Lighting Equipment

- Electrical Equipment

- Industrial Machinery

- Construction Machinery

- Test Equipment

- Power Tools

- Hand Tools

Service Expenses

These are expenses incurred during the six months prior to starting up. The key rule is that you needed to pay for these services prior to startup in order to get your business started:-

- Consultancy Fees

- Legal Fees

- Accountancy Fees

- Advance Advertising

- Websites and Internet Services

- Communications Costs

- Stock purchased in Advance

What to Do for Your First Self Assessment Tax Return

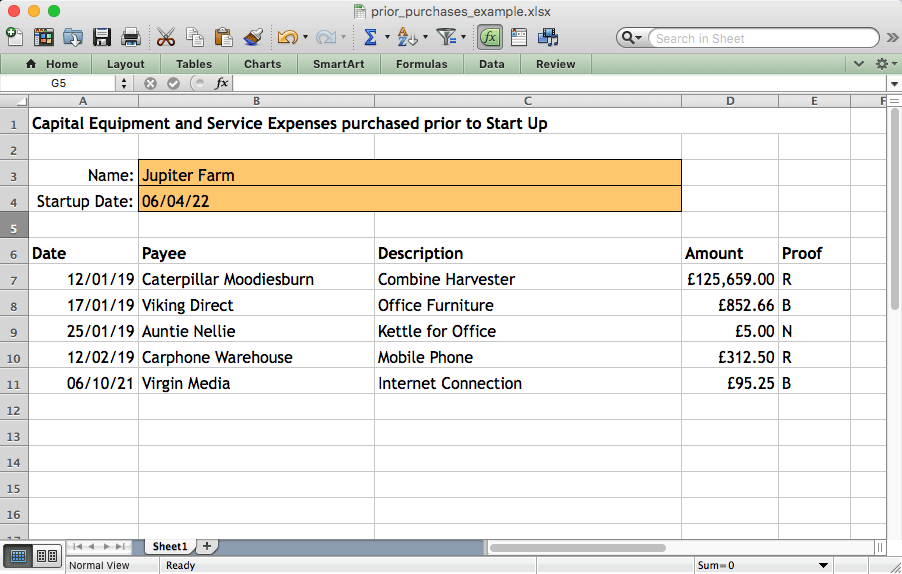

For your first self assessment tax return, make a complete list of all capital items and expenses purchased prior to your start date that you want to claim for. The list should include the ‘Date’ of purchase; the ‘Payee’ i.e. the company or person you paid; a ‘Description’ of the item or service; the ‘Cost’ of the item or service and ‘Proof’ of purchase.

In the ‘Proof’ column you can put a single letter, to indicate the degree to which you can prove your purchase: Use “R” to indicate that you have a ‘Receipt’. If you don’t have a receipt, use “B” to indicate that the purchase is verifiable on a bank statement (or credit card statement). Use “N” to indicate that you have ‘No Proof’ of the purchase. i.e. You do not have a receipt and it is not on a bank or credit card statement.

The image below shows a typical spreadsheet file with the required columns and sample data. You can download this example form or a blank stencil form for you to complete. Files are available as either MS Excel (.xlsx) and Open Office SS (.ods).

Your First Self Assessment – What HMRC say …

Follow the link below to see what HMRC say. Pay particular attention to “Work out the value of your item”